The “house” always wins. There are several popular maxims about Las Vegas and gambling, but the idea the house always wins is certainly one of them. Why does the house always win? It’s simple. The odds are in their favor, and they play every hand.

Probability and Possibility are not the same. You don’t need me to tell you this, Webster’s does a fine job. For those born after 1990, Webster’s is a company that published a large hard-bound book with tissue paper thin pages which every middle school student of my generation used to properly spell and define any challenging and lengthy word. We didn’t have Siri at our fingertips, we just had to work harder! Back to the task at hand – investing. When investing, any outcome is possible but is it probable? Could someone properly time the market and exit before a big drop, then subsequently time re-entry perfectly and make boatloads of money? Sure, it’s possible, but I would argue not probable. We want to believe it; look no further than the flood of articles and talking heads telling us the greatest market correction in history is already underway. Sell! Sell! Sell! Or….find the contrarian article suggesting there may never be a better time to get into equities. Buy! Buy! Buy! They both exist at the same time – all the time by the way. The talking heads never stop, because people are often irrational and driven by fear.

Probability pays the bills. We are taught to seek possibility. It is by it’s nature an aspirational word. It suggests endless opportunity – “imagine the possibilities.” And for many, entrepreneurs, thrill seekers, and technophiles, this is the horizon they chase. However, for most, we would likely favor probability. Which investment sounds better to you? I’m going to ask each of you to define “material amount” as at least 25% of your investment capital.

Investment 1: You can invest a material amount of money and there is a 10% chance your money will compound 20% per year over the next 15 years. (This means a $100,000 investment will be worth over $1.5M!) There is a 20% chance you will get your money back with no return, and there is an 70% chance you will lose it all.

Investment 2: You can invest the same material amount of money and there is an 70% chance you will earn 7% per year, (worth $275k over 15 years), a 20% chance you will be breakeven, and a 10% chance you will lose it all.

Which investment would you prefer? Remember, this is at least 25% of your investment capital so it’s material wealth for everyone. For me, give me the probability of Investment 2. Maybe that seems obvious because there is such a huge gap between the respective outcomes for each investment. Following this line of thinking, we could agree the difference between possibility and probability is really about risk and for me it’s about the greatest risk in investing: the permanent loss of capital – a risk I want to avoid.

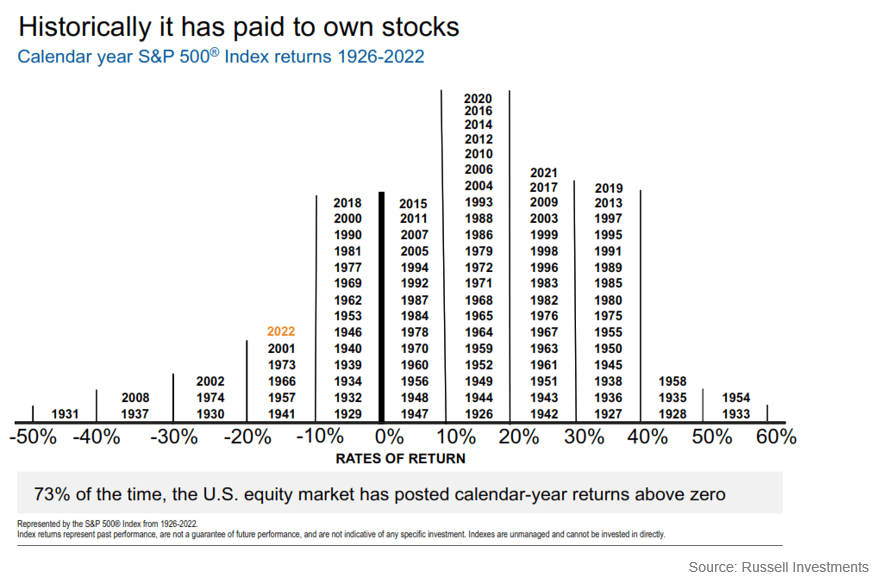

If the odds are in your favor, you just need to play every hand. This is the key to being the “house” in Vegas. Take a moment and study this chart:

Do you see it yet? Owning the S&P 500 index, a highly volatile stock index representing the 500 largest companies in the US provides odds in your favor, the probability that 73% of the time (historically at least) the index has offered investors a positive return (> 0%). Note the tallest stack is years where the index returned between 10-20%. Now, as a long-term investor, you need to play every hand – by staying invested! The Vegas casino knows there will be stretches where they’ll lose money, but they don’t quit out of fear because they know with the odds in their favor, they will win more often than not. I’m not guaranteeing that owning the S&P 500 index will mean that history repeats itself, but I do think we can use it as a barometer to determine what might be expected in the future.

Of course, there is a possibility you could find an investment that will return far greater than the 10.06% annual average return the S&P 500 index provided between 1926-2022. And if we know one thing, it is that our society loves a good possibility. See this frightening information from Visual Capitalist….

Can we agree the “Most Popular Online Betting Activities” are far less probable to land in your favor than the historical annual performance of the S&P 500 index? Let’s stop being bettors and start being investors.

Jamie